Report FinCEN's Beneficial Ownership Information (BOI) Reporting Requirements For 2024 Under New Law

This reporting mandate begins January 1, 2024!

CORPORATE TRANSPARENCY ACT

FinCEN BOI Reporting Made Easy

Ensure compliance with this new federal mandate.

Simple & secure online information collection.

Centralized data storage that streamlines information tracking and updates

Automated notifications to keep you up to date on ongoing filing requirements

Update FinCEN BOI reporting going forward.

We prepare and submit your filings to save you up to 3 hours per report.

Starting at $269 annually per entity

Put Beneficial Ownership Reporting on Autopilot

Failing to File Could Result in Fines or Imprisonment

Advisory

The Financial Crimes Enforcement Network, commonly called FinCEN, is an agency of the U.S. Department of Treasury that implements rules to improve transparency and prevent financial crimes.

Assurance

Under the Corporate Transparency Act, FinCEN published the Reporting Rule Beneficial Ownership Information (BOI), which went into effect on January 1, 2024.

Integrated Accounting & Tax

Approved Business Resource

To avoid serious criminal and civil penalties, businesses that form in 2024 must file a Beneficial Ownership Information Report (BOIR) within 90 days of forming. Business formed in 2023 or older you have about 55 days left to file. No matter when your business formed, we can help you determine your deadline and file for you.

Made Easy $269 Annually Per Entity

FinCEN Beneficial Ownership Information (BOI) FAQ

Why do companies have to report beneficial ownership information to the U.S. Department of the Treasury?

In 2021, Congress passed the Corporate Transparency Act on a bipartisan basis. This law creates a new beneficial ownership information reporting requirement as part of the U.S. government’s efforts to make it harder for bad actors to hide or benefit from their ill-gotten gains through shell companies or other opaque ownership structures.

[Issued September 18, 2023]

When Do I Report?

Reports will be accepted starting on January 1, 2024.

If your company was created or registered prior to January 1, 2024, you will have until January 1, 2025, to report BOI.

If your company was created or registered on or after January 1, 2024, and before January 1, 2025, you must report BOI within 90 calendar days after receiving actual or public notice that your company’s creation or registration is effective, whichever is earlier.

If your company was created or registered on or after January 1, 2025, you must file BOI within 30 calendar days after receiving actual or public notice that its creation or registration is effective.

Any updates or corrections to beneficial ownership information that you previously filed with FinCEN must be submitted within 30 days. FinCEN cannot accept reports before January 1, 2024.

Who is a beneficial owner of a reporting company?

A reporting company’s beneficial owner is any individual who owns or controls 25% or more of the ownership interests of a reporting company or who directly or indirectly exercises substantial control over the entity.

There are a few things you need to know to help you get start filling your company's BOI report:

There is no fee for submitting your beneficial ownership information report to FinCEN.

There is no annual reporting requirement.

Reporting companies must file an initial BOI report and updated or corrected BOI reports as needed.

Foreach individual who is a beneficial owner, a reporting company will have to provide:

The individual’s name

Date of Birth

Residential address

An identifying number from an acceptable identification document

Passport or U.S. driver’s license

The image of the identification documents

What does “substantial control” over a reporting company mean?

An individual has substantial control if they: 1) Are a senior officer (e.g., CEO, CFO, COO, or other executive level position with a high degree of authority); 2) Have the authority to appoint and remove senior officers and members of the board of directors or other governing body; or 3) Make, direct, or influence the company’s important decisions.

What is considered an ownership interest?

Any individual who owns or controls at least 25% of the ownership interests in a reporting company is considered a beneficial owner.

FinCEN's Reporting Exemption

FinCEN’s list of types of entities are exempt from the BOI reporting requirements.

23 types of entities are exempt from the beneficial ownership information reporting requirements. These entities include publicly traded companies meeting specified requirements, many nonprofits, and certain large operating companies.

The following table summarizes the 23 exemptions:

1 Securities reporting issuer

2 Governmental authority

3 Bank

4 Credit union

5 Depository institution holding company

6 Money services business

7 Broker or dealer in securities

8 Securities exchange or clearing agency

9 Other Exchange Act registered entity

10 Investment company or investment adviser

11 Venture capital fund adviser

12 Insurance company

13 State-licensed insurance producer

14 Commodity Exchange Act registered entity

15 Accounting firm16Public utility

17 Financial market utility

18 Pooled investment vehicle

19 Tax-exempt entity

20 Entity assisting a tax-exempt entity

21 Large operating company

22 Subsidiary of certain exempt entities

23 Inactive entity

Helpful Resources

To learn more about the BOI report, please visit the resource links provided below:

FinCEN's Official Website: Preparing and Filing your Beneficial Ownership Information

FinCEN's FAQ Section: Frequently Asked Questions about BOI Reporting

Woman-Owned Family Accounting Firm With Services Tailored To Your Company.

“Simple Accounting Solutions for a Complex Business World.”

In today’s hectic economy, simple solutions have never been more important. At Integrated Accounting & Tax, we aim to give honest, practical guidance that makes life easier for our clients.

As a woman-owned accounting firm with services tailored to each client’s unique needs and goals. We guarantee that every service we provide is essential and propels your goals.

Our firm has been in business since 2013, We started with our first location in Minnesota and extended to Florida as we follow our passions. We understand what it takes to own, run and grow a small business.

Plain and simple, you’re our top focus. We strive to ensure that every service we offer is integral to what you need as a business owner while fitting your end personal goals.

Accounting and Tax Services

We provide services in four areas essential in managing your business and personal finances:

Business Bookkeeping

Business Taxes

Compliance Services

Individuals and Families Tax Services

At Integrated Accounting & Tax, our goal isn’t simply to handle your accounting, taxes and regulatory compliance. We want to be your business partners and help you grow for years to come. Work with us and get back to doing what you love—running your business.

FinCEN BOI Initial Reporting

$269

Onetime

1 BOI Report Per Entity EIN/Tax ID Number

Initial BOI Reporting Service

12 Month Digital Compliance Check

12 Months Unlimited Updates

10 Point Business Check

Access To Cloud Document Portal

Compliance Portal

Local State & Taxes Apply

At Integrated, we understand that your BOI report is a crucial step in maintaining successful business compliance. Integrated can file your BOI report for $149 per entity, but the value you receive from Integrated goes beyond a simple transaction. Here’s why we stand out.

Unlike some other online filing companies, with Integrated you can rest assured that your information is safe, private, and never sold.

Your satisfaction is our top priority, so we strive for superior customer service. Our dedicated U.S. team is here to assist you at every step, ensuring that your experience with Integrated is smooth and stress-free. Unlike other filing companies, we won’t put you in a box with chatbots and slow support tickets. If you prefer to speak with a human, one of our dedicated filing experts is here to answer your call.

Integrated is more than a business formation and filing service, and your business is more than a simple transaction. Other companies focus only on the transaction, but we are committed to supporting you throughout the entire lifecycle of your business. From initial business name checks and entity formation to registered agent services, payroll tax registration, and BOI reports, we aim to be your trusted business filing partner.

We believe in the quality of our service. That’s why we offer the industry’s best 100% satisfaction money-back guarantee. If you are not 100% satisfied with our services, we will refund 100% of our service fees, no questions asked! Please see our Integrated Guarantee for details.

We’ve designed our ordering process to be the easiest in the business. Streamlined and user-friendly, our platform allows you to complete the necessary steps with minimal effort, saving you time and ensuring accuracy. And if you ever have questions, our team of U.S. filing experts is here to help you – over the phone, via email, or on chat.

We want to be an extension of your company, consulting you each step of the way.

If you have any questions that we don’t cover below, please feel welcome to contact us today.

Accounting firms should be approachable and honest with their clients. That’s why we’re always ready to have open dialogue whenever people need to discuss their finances or

our services.

Plain and simple, you’re our top focus. We strive to ensure that every service we offer is what your business needs.

You’ll get the help you need to enhance, streamline, and succeed. Best of all, you’ll be able to ditch the stress of finances and get back to doing what you love!

It’s our job to define the areas of opportunity (grey areas) and how they apply to your small business.

"Accounting and taxes aren’t as black and white as many think,

we believe in having honest conversations."

Testimonial

Our Clients Reviews

I’ve used Gene for several years now to prepare my taxes. After I moved out of state I felt it best to continue using him. I’ve not been disappointed. Thank you, Gene and team!

Rebecca B.

The sign of a great business or in this case Integrated Accounting & Tax LLC is the great customer service from Gene and Tricia!

Norm P.

Get In Touch

Email: [email protected]

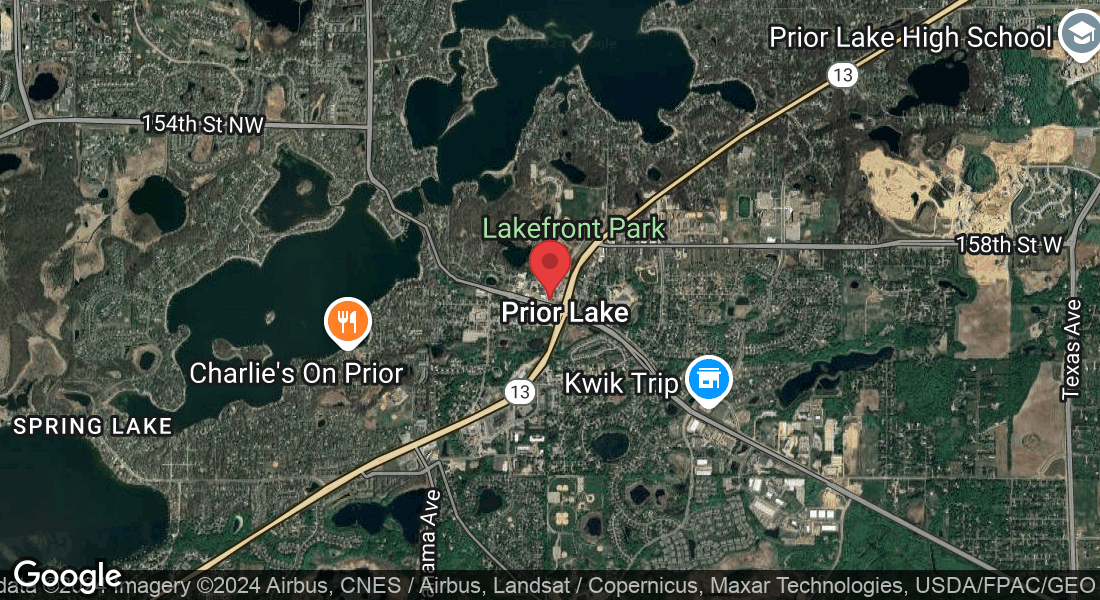

Address

Office: 16180 Hastings Ave SE #302

Prior Lake, MN 55372

Assistance Hours

Mon – Friday: 8:00am – 6:00pm CST

Saturday: Email or Appointment

Sunday – CLOSED

Phone Number:

952-395-8030